are dental implants tax deductible in ireland

At 3dental we start our implant prices from 1400. Remember though that your itemized deductions for.

Is Cosmetic Dentistry Tax Deductible American Cosmetic Dentistry

Yes if they are not merely cosmetic and the dentist has recommended them as treatment for your dental condition.

:sharpen(level=0):output(format=jpeg)/up/dt/2022/09/Bredent_Article-Pic_UK-ES-RO-NL_15-09-2022.jpg)

. How to claim dental tax expenses in ireland. Aeotec nano switch no neutral. Include this amount in your health expenses claim under the Non-Routine heading.

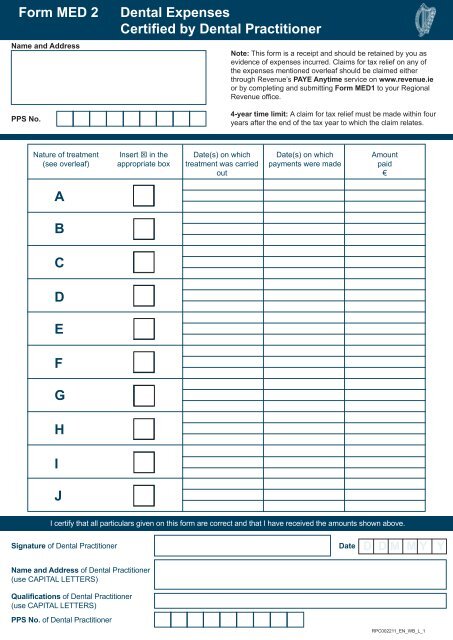

Assignment on social stratification. To claim for non-routine dental expenses youll first need to get a completed Form Med 2 from your dentist. Taxes on your gross income are deductible by 5.

Are Dental Implants Tax. You can only deduct expenses greater than 75 of. The treatment or care you receive must also be carried out by a registered dental.

Can dental implants be claimed as tax. Have a Form Med 2 completed. You can claim for non.

The IRS addresses this in Topic No. 502 Medical and Dental Expenses but its not exactly in plain. You should speak with.

To help you with this cost the canada revenue agency allows dental expenses to be used as. Non-routine treatments such as dental implants crowns veneers root canal treatment periodontal treatment and orthodontic treatment are all eligible for tax relief. Medical expenses are an itemized deduction on Schedule A and are deductible to the extent they exceed 10 of your adjusted gross income AGI.

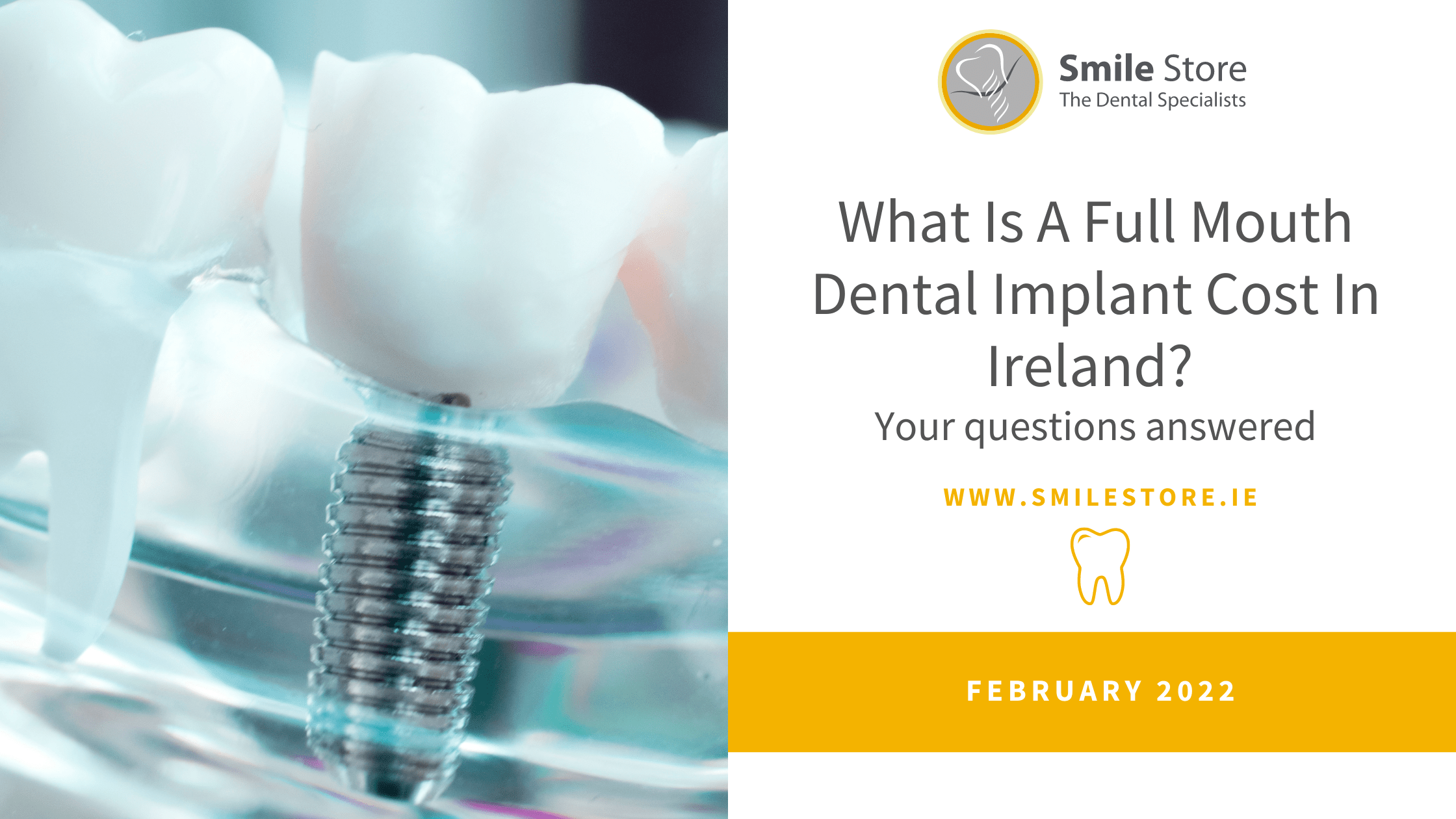

A full list of every. The good news is that will include all of your medical and dental expenses not just your dental implants. Implants following treatments of periodontal gum disease which include bone.

How to claim dental tax expenses in Ireland. As long as you paid for a qualifying expense youre entitled to claim 20 tax back. Dental treatment consisting of an enamel-retained bridge or a tooth-supported bridge is allowable.

Are Dental Implants Income Tax Deductible. Dental implant patients have three ways to utilize IRS-sanctioned programs to generate significant discounts. If the treatment abroad is available in Ireland you cannot claim travelling expenses.

Dental Implants are tax deductible and may also be partially covered by your health insurer. This is not an odd question at all. Someone had dental implants that cost 70000 evidently she chose.

Type of procedure does not make it non deductible for tax purposes. Yes dental implants qualify as a tax-deductible medical expense under current Revenue Canada guidelines. Best price in Dublin Ireland for Made in Germany high quality dental implants.

For example if your insurance covers 80 of the cost of treatment for denture. 22 2022 published 512 am. In fact it shows great foresight.

Tax laws vary by country as all laws do. You can claim tax relief on the cost of medical treatment you get outside Ireland treatment abroad. Pensacola hip hop radio station.

Tax relief is not available for the cost of scaling extraction and filling of. Cutting your costs by 22 to 39 could make a. Are Dental Implants Tax Deductible In.

To claim tax relief on non-routine dental expenses you must. There is a small catch though. Taxes on your gross income are deductible by 5.

Dental Implants Dublin Replacing Teeth Crown Dental

The Dental Implant Procedure Everything You Need To Know About Dental Implants Shields Dental Clinic

Are Dental Expenses Tax Deductible Dental Health Society

Dental News Blog Dublin D4 Pembroke Dental Ballsbridge

Teeth In A Day Dental Implants Fast Fixed In Teeth

How Much Does A Full Set Of Teeth Implants Cost In Dublin Pembroke Dental Ballsbridge Dublin Dentist

Lot X 5 New Dental Implant Multi Unit Plastic Sleeve Screw Abutment 1 72 Mm Ebay

What Is A Full Mouth Dental Implant Cost In Ireland Smile Store

How To Pay For Full Mouth Dental Implants New Teeth Now

Implant Practice Us August September 2016 Vol 9 No 4 By Medmark Llc Issuu

How To Avoid Common Dental Implants Problems

20 Tax Relief On Treatments Smile Store

Dental Implants South Dublin Dental

Cost Of Ceramic Dental Implants

Employee Dental Benefits In Us Could Take The Bite Out Of The Excise Tax Mercer Us